Austin continues to grow in terms of real estate valuation, population, new businesses relocation (physically and virtually), and infrastructure. There is no doubt in my mind that Austin will continue to appreciate gratuitously. I believe this to be the case for many reasons including but not limited to the following:

1) Apple is moving a “headquarters” to Austin.

That won’t happen for about 5 years; however, construction will begin this year. This means 5,000 employees, one million square feet of office space, and a BILLION dollar investment. That is big, international money. Apple is one of the largest contributors to the GDP of the US at over 1%.

“…Apple is worth over 1% of the world’s GDP according to the latest estimates from the World Bank that peg the world’s output at $80.6 trillion. (Investopedia)

2) Austin is still cheaper and smaller than many other comparable cities.

It may not seem like it to us local Austinites but Austin still has a LOT of room to grow (outward and upward), offers cheaper living than: the Bay Area, L.A., New York, Seattle, & D.C., and has no state income tax. This is quite appealing to individuals looking to relocate to Austin from these places. If you have lived here long enough, you have met a lot of people from these cities and the surrounding areas. In terms of growth, downtown is planned to have at least 6 towers that are planned and will be built over the next 5 years; these are just the deals that I know about- there are likely many more. In addition to downtown, Austin has large Planned Unit Developments (PUDs). The Domain, Mueller, and Goodnight Ranch are several well known communities in town. these are growing rapidly and the homes surrounding them are appreciating above market as a result.

3) Interest rates are low and there is no rent control in Austin (or Texas).

For investment property owners (commercial and residential alike), this is a positive thing. Today (August 2019), an investor can buy a property with a very low interest loan (in the 3-4% range) with 20-25% down. Since a loan is amortized, the monthly payment remains the same while rents continue to inflate with the market. The longer you hold the property, the larger margin you make on month net rent profit; this does not include the equity appreciation an investor would receive simply by holding a property. It can be a lucrative investment if timed correctly and purchased in the right location.

There can be drawbacks to not having rent control. One is cost of living difficulties. While property values are increasing, not all jobs in Austin are getting the proper increase in wage/salary to compensate for the changing cost of living. In a high growth cities around the country, there is a similar problem (Seattle, New York, The Bay Area). Without rent control, cities see increased homelessness and physical segregation by income sometimes even race. Placing rent control laws on a city would have dire consequences for property values in high investment neighborhoods and would stunt the growth of the city in almost every way. When cities are trying to combat inflation and outperform other cities to attract large corporations and outside investment, this would be a death sentence.

City of Austin Breakdown

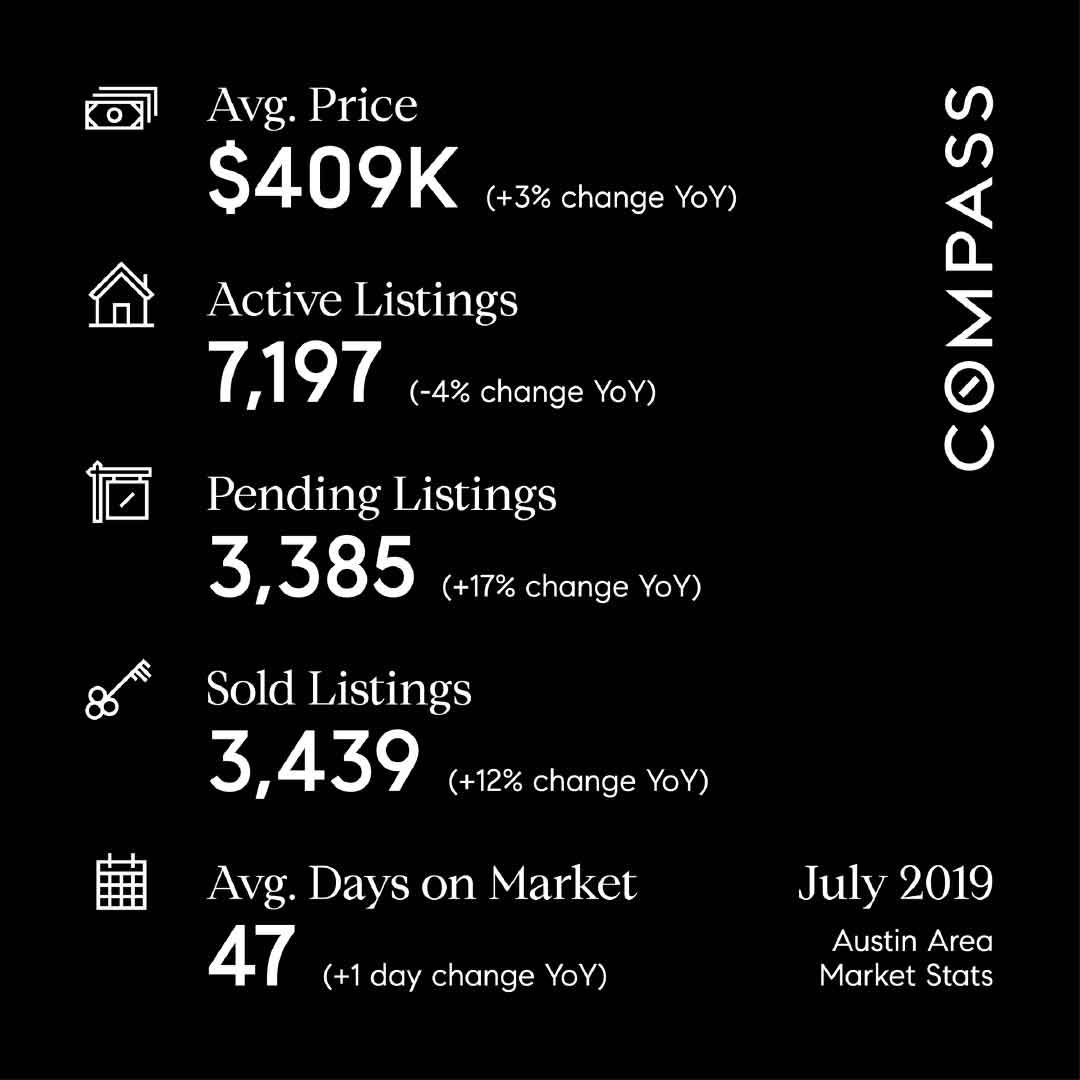

Average Price:

Average prices have risen 4% YoY. This indicates that there is a high demand for property and not enough new supply to compensate for it. In turn, this increases property values of existing homes.

Active Listings:

There are less active listings available for buyers to potentially purchase; this means that there are just as many people (or more) looking to move to Austin and buy (or rent) and there are less options from which to choose. This leads to increased pricing.

Pending Listings:

There are more pending listings (+10% YoY) with LESS overall listings on the market. This is a STRONG indicator that demand is high. regardless of the cost of living, people continue to move here. There are still many places in the US that are more expensive than Austin with less to offer (in my opinion).

Sold Listings:

The number of Sold listings is around the same. I believe this to be that there are so many off-market transactions happening in Austin now that it is hard to rely on Sold data.

Average Days on Market:

The average days on market decreased by 3 days from 32 to 29 days. This means that it is taking less time to sell more properties, for a higher prices, all while have less inventory. That is pretty crazy to think.

Summary

We may be headed for a recession on the national or global level. There are strong indicators of that, no doubt; The Fed lowering the federal funds rate is a prime example. As far as Austin Goes, I believe that is will continue to appreciate even if a recession were to occur. From about 2009 – 2012, people really struggled in the national real estate markets, stock markets and bond markets; AAA rated mortgaged-backed securities were failing and large multinational banks and investment funds were declaring bankruptcy. It was a frightening time. In Austin, real estate values held; honestly they even continued to appreciate just at a lesser rate. Austin has several insulators: It is the State Capitol, it is home to the University of Texas (top 5 football followings in the world), and is the onbly city of its kind in Texas. Other comparable cities all have a state income tax. I believe Austin will continue to grow over the next 10 years at least.

If you are looking for a property or looking to sell your property, I would be happy to help.

– thatbeardedrealtor (Marcus)

“

The service that Marcus provides to his clients is unparalleled. He is a true professional.

Related Articles

Real Estate Update 12/18/19

Luxury Construction The number of new-construction luxury homes at 3,000 square feet or less has...

Real Estate Market Update 12/10/2019

Are we headed to a recession? While we survived the year of RECESSION OBSESSION without a...

Real Estate Update 12/5/2019

Mortgages Mortgage application volume decreased 9.2% from the previous week, according to the...

Sponsoring Broker:

Compass RE Texas LLC

call: 512 575 3644

visit: 801 Barton Spgs Rd, 6 Floor

Austin, TX // 78704

site: compass.com

Information About

Brokerage Services

Texas law requires all license holders to provide the Information About Brokerage Services form to prospective clients.

Click here

Consumer Protection

Act Disclosure

Texas law requires all license holders to provide a link to the Consumer Proteection Notice form to prospective clients.

Click here

All right reserved Marcus Roper 2019

Marcus Roper is a licensed Realtor in the State of Texas

and an agent of Compass Real Estate, LLC

Let me know what y’all think about my synopsis! I’d love to go back and forth about the direction of the market. If you’d like more info on housing and the Austin market, create and account on this site and follow me on IG: @thatbeardedrealtor